The Merge is upon us. It's been 8 years in the making. Everyone is talking about it. Fox News even wrote about it. We’ve seen the PA, the dYdX and Bybit liquidations. We've see the line charts. BUT what actually is "The Merge"? Let’s dive in.

Fair warning: this blog is not technical.

Back to Basics

The Merge marks the Ethereum network's shift from Proof-of-work to Proof-of-stake. Don't worry, this will make sense in a minute.

What is Proof-of-work?

Proof-of-work (PoW) is a consensus mechanism. In a decentralized ecosystem, you need one source of truth and rules to enforce agreement. Proof-of-work (PoW) generates that one source of truth. It forces consensus on things like transaction order, account balances. It prevents double spending, users creating new tokens etc.

Simply put, PoW stops people from gaming the network and makes it difficult to attack. Sounds great right?

Problems with PoW

PoW has problems: high energy consumption, kinda centralized mining, risk of 51% attacks, isn't scalable. Let’s quickly go through these issues in a little more in depth before we hit the Proof-of-stake.

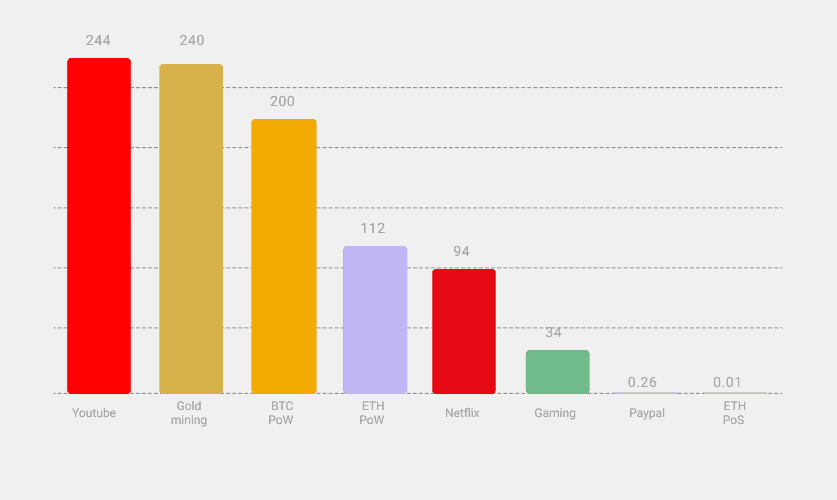

Energy Inefficient: This one gets a lot of attention and probably gets the most heat (pun intended). Transactions require a ton of energy.

Mining companies have been in a mad dash to buy and run enough hardware to increase their chances of determining the next Ethereum block. Operations run 24/7, 365 in order to maximize profits. Not great. People don't love this.

Difficult to Participate: You need expensive and difficult to maintain hardware to mine blocks. Only a few companies manufacture that hardware. This means a small group controls distribution and mining operations can be pretty centralized.

51% Attacks: Blockchain is supposed to be immutable. 51% attacks threaten that immutability. If an attacker gains 51% control of total hashrate, the attacker can block transactions, reverse transactions or double spend tokens.

Not Scalable: Transactions are slow and expensive. Cue the classic example that Ethereum can only handle ~10-30 tx per second while Visa can handle ~2000.

Enter Proof-of-Stake

We covered Proof-of-work. So, what is Proof-of-stake?

Proof-of-stake (PoS) is Ethereum's white knight solution. PoS should make the network more secure, less energy-intensive, more scalable. We love this. But it's also been incredibly complex to build, refine and now implement.

What is Proof-of-stake?

Poor man's definition: Validators are the new miners. Validators stake ETH. Validators lose ETH if they behave dishonestly. Validators gain ETH if they behave honestly.

Ok, what’s so great about PoS?

Energy Efficient: PoS reduces Ethereum's energy consumption by ~99.95%. It uses less energy because there aren't any miners burning crazy amounts of energy.

Easy to Participate: PoS has a lower barrier to entry. You need 32 ETH and a laptop. This means that more people should participate in securing the network.

51% Attack: 51% attack is still a threat but it would cost an inordinate amount of money (even by crypto standards). And because there is a lower barrier to entry, more participants will secure the network which makes it much harder to takeover.

Scalability: More validators, more participation. That said, there are some misconceptions here. The Merge primes the network for future scalability upgrades. In the interim however, we will not see cheaper or faster transactions. More on that later.

Check out energy consumption stats below.

Becoming a Validator

Cliff notes on how to participate as a validator.

You can either use a custodian like Lido, Coinbase, Binance or you can fly solo. Custodians will handle the staking in exchange for a fee. If you don’t want to use a custodian, you need to set up a staking node. So, basically get a computer with a lot of memory, sync an execution and consensus layer, monitor and maintain your node.

To participate as a validator, you need to deposit 32 ETH. In return you earn rewards. Currently the APR is ~5%. If you don’t have 32 ETH, you can participate in a pool.

There are some risks with each option. As a validator you get penalized if you go offline. Custodians introduce middlemen. Pools carry the usual contract exploit risks.

It is important to remember that you can't withdraw your ETH after The Merge. The Shanghai upgrade will enable withdrawals. So you’re looking at locking your ETH for at least 6-12 months.

Currently there are ~15 million ETH staked and ~500k validators.

What's the Problem?

There are obviously nerves around the actual implementation. Ethereum's market cap is $209.283B with thousands of dapps on it. Self-explanatory.

There is also fear that regulators may try to push the largest validators to censor transactions. Community members seem aligned that censoring blocks constitutes an attack on the network. So, if a custodian is cool with censoring, their stake could be burned. This conversation is very much ongoing especially in the wake of the recent Tornado Cash sanctions.

Some worry PoS makes Ethereum more centralized because a few entities control a ton of the supply eg. Lido at 31%, Coinbase 14% etc. (These are custodians and not holders). Some worry PoS makes Ethereum more centralized and less secure because malicious actors can try to buy out the network.

And then we have some smaller chirping from the sidelines. Mainly, miners are upset because they need to find new sources of income.

Post Merge Considerations

Ethereum mining pools are out. Staking pools are in. People that run mining operations should probably check Upwork job listings. Jokes aside, miners will probably just turn their efforts to other coins which is why we saw a spike in ETC last week.

The Merge doesn't magically fix gas fees. This is actually a pretty big misconception. The Merge doesn’t expand the network capacity which you need to do in order to lower gas fees. You also won’t see magically faster transactions. That said, blocks will be produced ~10% more frequently.

Again, for the people in the back, if you're a validator, you cannot withdraw your ETH after The Merge. You’re looking at locking your ETH for at least 6-12 months. That said, you do get tips/MEV credited from block proposals.

And then there is everyone's favorite topic: MEV. MEV is how miners maximize profit. The Merge gives current MEV searchers a formal economic role a new economic class: "block builders". These block builders will compete in a marketplace that provides validators with the most profitable blocks, in real-time. PoS validators will have the option of which MEV ordered blocks they want to accept. For example, a validator with a reputation like Coinbase might choose to avoid proposing blocks that contain sandwich attacks.

Stepping back, The Merge is a big deal. The hype is warranted. Who knows if it's priced in. Let me TA that... In the meantime, congrats to the community.

As for what's next?

The surge, verge, purge, and splurge. (Seriously).

Welcome to the future of finance.