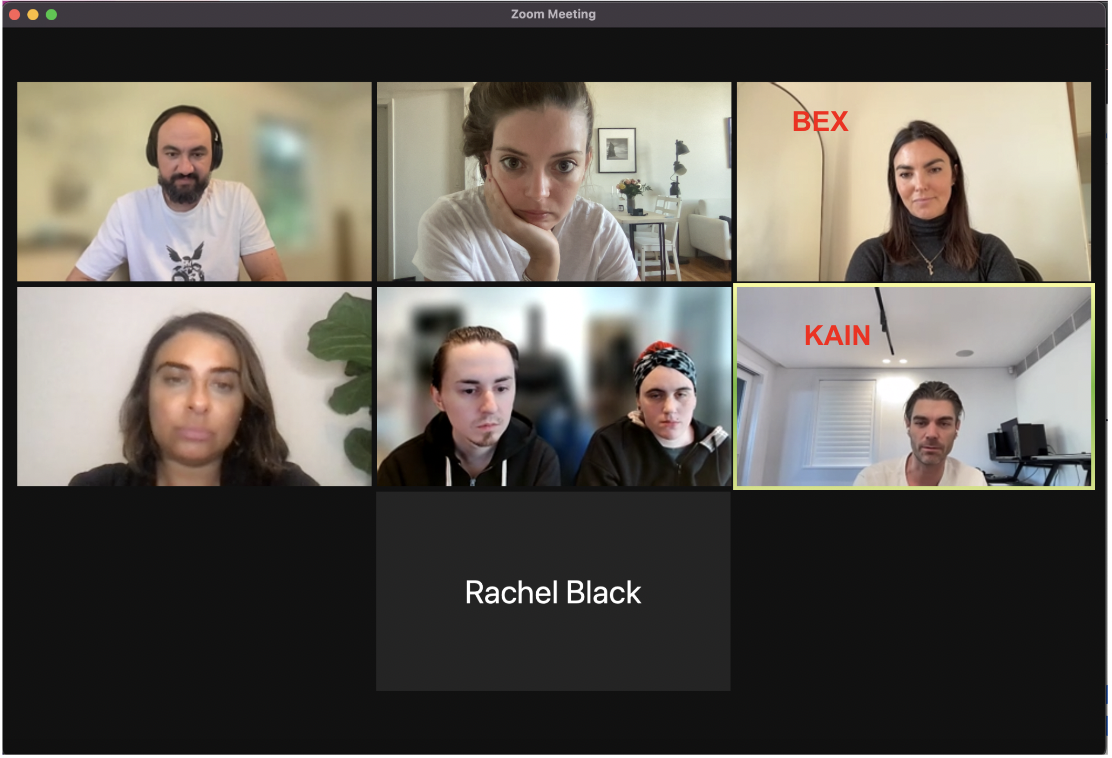

— Kain Warwick during one of our mentorship sessions.

If you didn't know, Kain runs a biannual female mentorship program. This is his second year doing it. I joined in August. It's been one of the best crash courses into DeFi that I could have asked for.

Halfway through, I've been reflecting on my experience. I wanted to share some thoughts and highlights.

First, some program context. Second, some favorite Kain quotes. And then let's dive into the last 6 weeks.

How it Started

It started with a tweet.

Laura Shin boosted Kain's roll call for female mentee applicants —

I saw the tweet and I was really moved that a female wanted to so selflessly give back. I also thought it was pretty wonderful that Laura would support another woman in the space. We love a good girl gang.

0xTuba quickly corrected me that I'd fallen for the pfp rug yet again. First learning: Kain is a guy.

This was embarrassing and a clear cry for help which is probably why I got into the program. Nonetheless...one application, two interviews later, coffee with Kain in NYC and I got in.

Coming into crypto, as an outsider, has actually been pretty challenging and isolating. Couple that with imposter syndrome as a first time founder, a war, a bear market and this program couldn't have come at a better time.

Program Structure

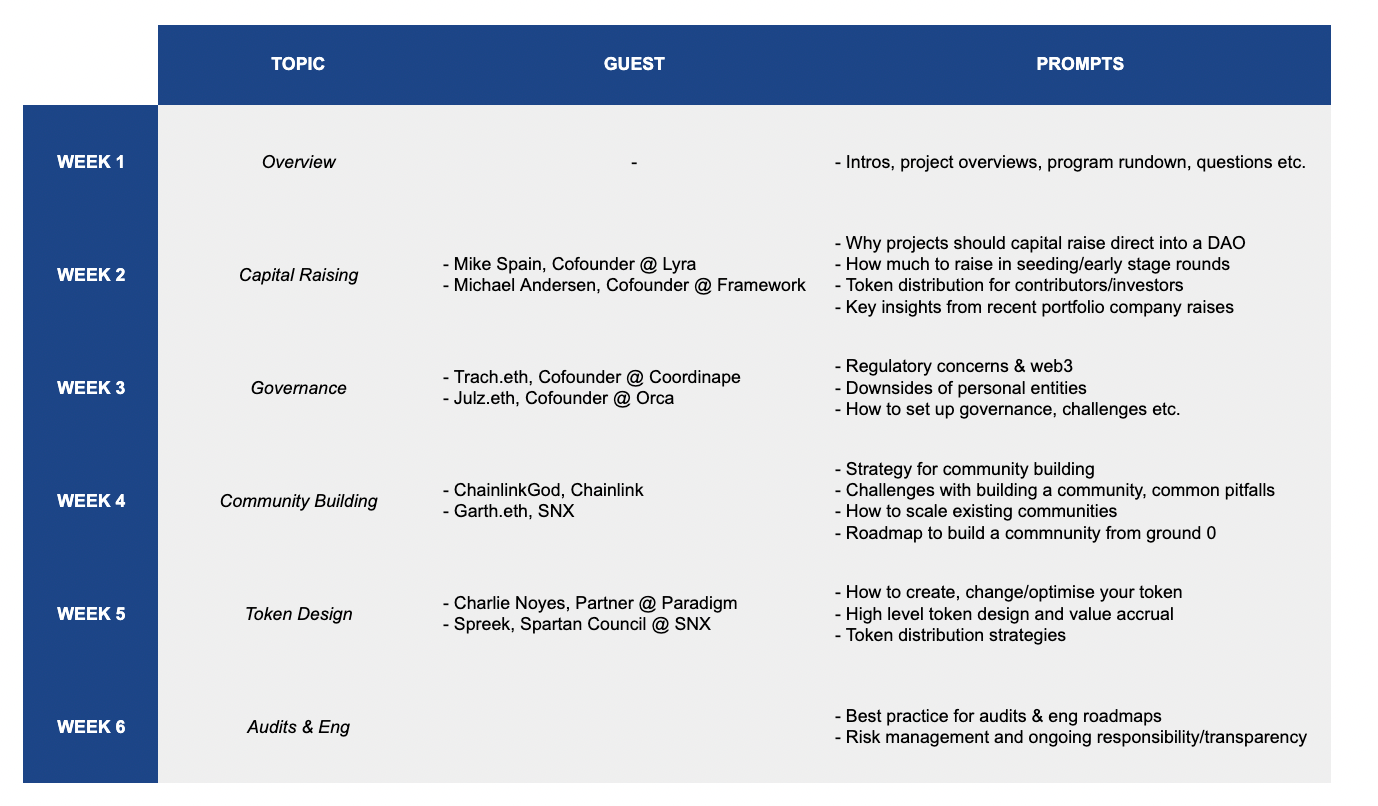

I don't want to offend Kain but I was shocked by how organized the program was. Crypto is crazy. I pretty much expected a bunch of miladys in a discord pinging Kain questions. Instead, it's been the total opposite. Structure:

- 10 weeks.

- 4 mentees.

- ~8 modules ranging from fundraising, governance, tokenomics etc.

- Two weekly meetings with Kain:

- 1 hr group meeting with guest speakers.

- 45 min 1-1 with your protocol.

Huge shout-out to Bex who is Kain's righthand/sidekick who managed the whole thing. Bex created essentially a college syllabus with articles, videos and a weekly break down of specific topics + speakers.

Kain & Bex have spent a ton of time with us. They are super accessible and generous about introductions, ideas, feedback etc. The fact that Kain spends 45 mins solo with the entire SIZE team each week still blows my mind.

Highlight Reel

Some Kain quotes to set the stage.

1. "Jetlag doesn't exist.”

Jetlag exists in economy.

2. "I don't believe in the law.”

Syndicate vibes.

3. "Don't build cathedrals in the sky."

The full quote was: if you build a cathedral in the sky, you'll forget the doors. Probably my favorite quote and reminder to stay flexible, avoid building in silos and getting overly attached to your own ideas.

4. "Don’t walk through one way doors.”

One way doors can be lethal especially in a fast and loose space. Kain normalized slowing down. AKA. Don't actually code in prod. Be deliberate about your product's surface area. The answer to "can the devs do something?" can be "...no".

5. "Drip features don't drop them."

Kain talks a lot about the importance of narrative and meta-game in crypto. Web2 is very current narrative based. Web3 has a next thing narrative. Drip features to users; build narrative momentum. Big culture shift for me.

6. "Community is your critical mass."

Community is the most important component of the ecosystem. Be human, keep it organic. Build and govern with your community.

7. "Liquid democracy quickly becomes a backdoor election."

Kain is pro-DAO but also keenly aware of its shortfalls and nascency. He talked a lot about governance theatre and an uptick in DAO politicism. Kain also thinks DAO politics will only escalate eg. wen campaign videos.

8. "You didn't miss the boat, they're all still docked."

It's hard to miss the boat in crypto. We really are still early. Just do it.

Weeks 1-6

Ok so we you have program context, you read the quotes. Time for a deep dive into the actual program.

Week 1: GM

The first week was essentially a meet & greet for the mentees.

- Me. hi.

- Nicole from Tapioca (layer zero money market).

- Rachel from GoodGhosting (savings pools on Polygon).

- Seema from Nuggets (self-sovereign digital identities).

Week 2: Capital Raising

The first real group session was about capital raising. SIZE closed its round in April so I basically felt myself Monday morning quarterbacking the entire time. Good lessons for future raises though.

For the session, Kain brought in Michael Andersen from Framework & Michael Spain from Lyra. Framework invested in Lyra which is a DEX for options and a Framework portfolio company.

The conversation ranged from raising into a DAO, how much to raise, token distribution etc.

Investment Philosophy

Michael talked about how Framework approaches investment decisions. Framework has a 5-7 year time horizon on investments. Ownership stake matters and the team usually targets a 2.5%-10% stake. The team often doubles down through rounds.

When reviewing pitches, Michael prioritizes the founder & team, the sector and then the PMF because 'product can be fungible'.

Michael also talked about how he favors going in on cap tables that have 1-2 leads and then a lot of angels. Kain agreed that angels typically have more skin in the game. SIZE angels have been beyond helpful. Can attest.

This is all pretty common sense.

Investing Pre vs. Post Token

Michael and Kain were pretty aligned on how they think about investing in projects with or without a token.

The consensus was that it doesn't really matter. The main difference being that token price can be noisy and distracting. Also, there should be a clear 'why token'. The token shouldn't be the main value prop.

Kain stressed that it's important to build a base of liquidity prior to token launch. Particularly if there are violent deleveraging events on the horizon. Keep 12 months minimum of runway. Runway gives you stability and time to weather the storm. We have all seen this first hand.

Kain shared his experience raising after the SNX token launch when it was bouncing between .05 & .15 cents. He said it was noisy & took longer to close because price fluctuation became a distraction. Ref: SNX hit $20 dollars at peak.

Raising into a DAO

Kain was vocal about raising into a DAO. 2021 ETH CC 2021 and Bankless videos of Kain talking about it at length. tldr;

- Corporate governance is a bad coordination mechanism

- DAOs transcend legal structures and jurisdictions.

Week 3: Governance

Governance was up next which makes sense because governance & capital raising are intertwined if you raise into a DAO. For this section, Kain brought in Julia from Metropolis (FKA Orca) & Tracheopteryx from Coordinape.

- Metropolis is building on-chain permissions for DAO working groups.

- Coordinape is building decentralized compensation for DAOs.

Governance 101

Kain, Julz and Garth all agreed agreed that Governance is one of the most overlooked and unsolved areas of crypto. Governance is key if we want to make decentralization work.

Today, there's a lot of voting power consolidation and very little process. There is also very little process for when the processes in place break down. Ref: any governance thread ever.

Kain emphasized that governance forums default to throwing votes and that governance has fallen into the usual traps of a traditional democracy. Single channel decision making doesn't work. People should be well matched to make decisions.

Their advice? Figure out the surface area of what is governable. Decide early how you want to approach governance. Lay down the right governance infrastructure upfront. Once something is valuable, people very quickly want control. Start governance during a bear market because bull markets are too chaotic.

Improving Governance

Acknowledge that there are different forms of code. Good governance needs both:

- Socialware: off-chain consensus on things like policies, relationships etc.

- Trustware: anything backed by the blockchain.

A board of directors (eg. Synthetix's Spartan Council) can help corral community, align stakeholders. Boards also are a good forcing mechanism to aggregate votes more methodically across an ecosystem.

Else? The perfect system doesn't exist. Don't try to design the perfect system. Experiment. Stay agile.

Coin Voting

One of my favorite Kain points. Again, Kain is pro-governance. He believes that the group mind is more powerful than brittle hierarchy and that the corporate structure has failed. However, he also thinks though that governance as it stands today is not it.

Kain made the points that: coin voting is too narrow, collusion is a form of soft power, there is a lot of governance theatre. Cue quote: liquid democracy quickly becomes a backdoor election.

Week 4: Community Building

Community followed governance. Kain, Chainlink God and Garth (ex-SNX) talked about their experiences. SNX & LINK both have really active communities and a lot of the stories rhymed. I love the Link Marine antics on twitter so I was amped to meet Chainlink God. He lived up to the hype.

Community vs Users

Users are different than community members. Sometimes they overlap but more often than not, community members are solely token holders. I thought that this was an interesting distinction. A lot of Link Marines probably have not interacted with an oracle etc.

Don't Underinvest

Kain basically hammered in the point that community is one of the most powerful weapons in your arsenal. When done right. Community can become your decentralized messengers and decentralized marketing. He talked about how SNX community shrank to 3k during the prior bear market but was able to persist. SNX discord has ~50k members today. The most powerful communities are the communities that keep it human.

With that, founders need to be in the weeds. People can tell when you don't care. Be responsive. Be deliberate in communications and messaging. Rolling back messages can be really painful.

Keep it Organic

Community needs to be organic. If forced, it's not sustainable and it will deteriorate. Also, don't censor what the community talks about. When you start to ban topics like token price, you just create walled gardens and push people outside. Once you fork your community, you lose momentum.

Lastly, it's important for protocols to have alignment with communities but not control over them. Arm's length partnership. Control kills communities.

Week 5: Token Design

Last week, we met to discuss token design. Kain brought in Charlie Noyes from Pardigm as well as Spreek from SNX. Loyal SNX turnout in the program.

Kain talked a bit about 2018 early token designs and called out some differences when you look at token design today.

To be honest, most of the conversation was a bit sensitive. I'm based in America so I'll keep it PC and brief. Quick takeaways:

- Crypto markets don't love buy and burn and seemingly prefer direct distribution. There are pros and cons but the degens gravitate towards immediacy and visibility even if long term buybacks have a higher ROI.

- Kain is an advocate of people staking tokens. We need more staking (maybe). Currently, there is a gulf between active and passive holders. There could be more mechanisms so that passive token holders get better yield.

- In a lot of cases, tokens have been instruments of misalignment. A lot of things don't need tokens. Tokens should be valued based on underlying cash flow and the best ones like Maker have a clear discounted cash flow value.

- People like the airdrops.

And, that's a wrap.

You got the summary of the first half of the mentorship program. A lot of info but I warned that the program is comprehensive.

If you made it through the read, congrats & thank you. Hopefully this was helpful (or entertaining). At minimum, you learned Kain is a guy. With that, I definitely encourage people to apply to Kain's next cohort.

Next week's workshop is eng roadmap & auditing. Wish me luck.